Roman Pidkovenko is a lawyer in Khmelnytskyi with 4 years of experience. He specializes in credit disputes, mobilization issues, family, and civil law. Provides legal consultations, represents clients in court, and prepares claims and complaints. Assists with divorce cases, mobilization deferrals, and debt collection.

Successful Reduction of Client’s Credit Burden

Financial difficulties can be a serious challenge for anyone, especially when debt obligations become overwhelming. A client sought legal assistance due to a high interest rate and constant pressure from the creditor. He was looking for ways to optimize his debt to avoid severe financial consequences.

A legal analysis of the contract revealed possible ways to resolve the situation. It was decided to act as an intermediary between the client and the financial institution. Thanks to a well-structured negotiation strategy, a significant reduction in the client's credit burden was achieved.

Many financial institutions impose excessive interest rates and penalties, making it difficult for borrowers to meet their obligations. However, legal mechanisms allow for the review of loan terms, especially when violations are detected. By carefully analyzing the contract, we identified strong legal grounds to negotiate a reduction in financial obligations.

Each case is unique, and the approach to negotiations must be tailored accordingly. One of the key advantages of this case was achieving a successful resolution without resorting to court proceedings. With professional legal support, the client obtained the best possible conditions for reducing debt.

Legal Actions Taken

- Analysis of the credit agreement and interest accrual conditions.

- Evaluation of the legality of imposed penalties and commissions.

- Negotiations with the creditor regarding the revision of financial obligations.

- Agreement on partial debt forgiveness.

The negotiation process involved not only formal legal requests but also a structured argumentation of the client’s position. By applying a comprehensive legal approach, we successfully achieved a significant reduction in debt without court involvement.

Key Stages of Work

- Reviewing the case and analyzing the credit agreement.

- Preparing justified requests to the creditor.

- Conducting negotiations to reduce the debt burden.

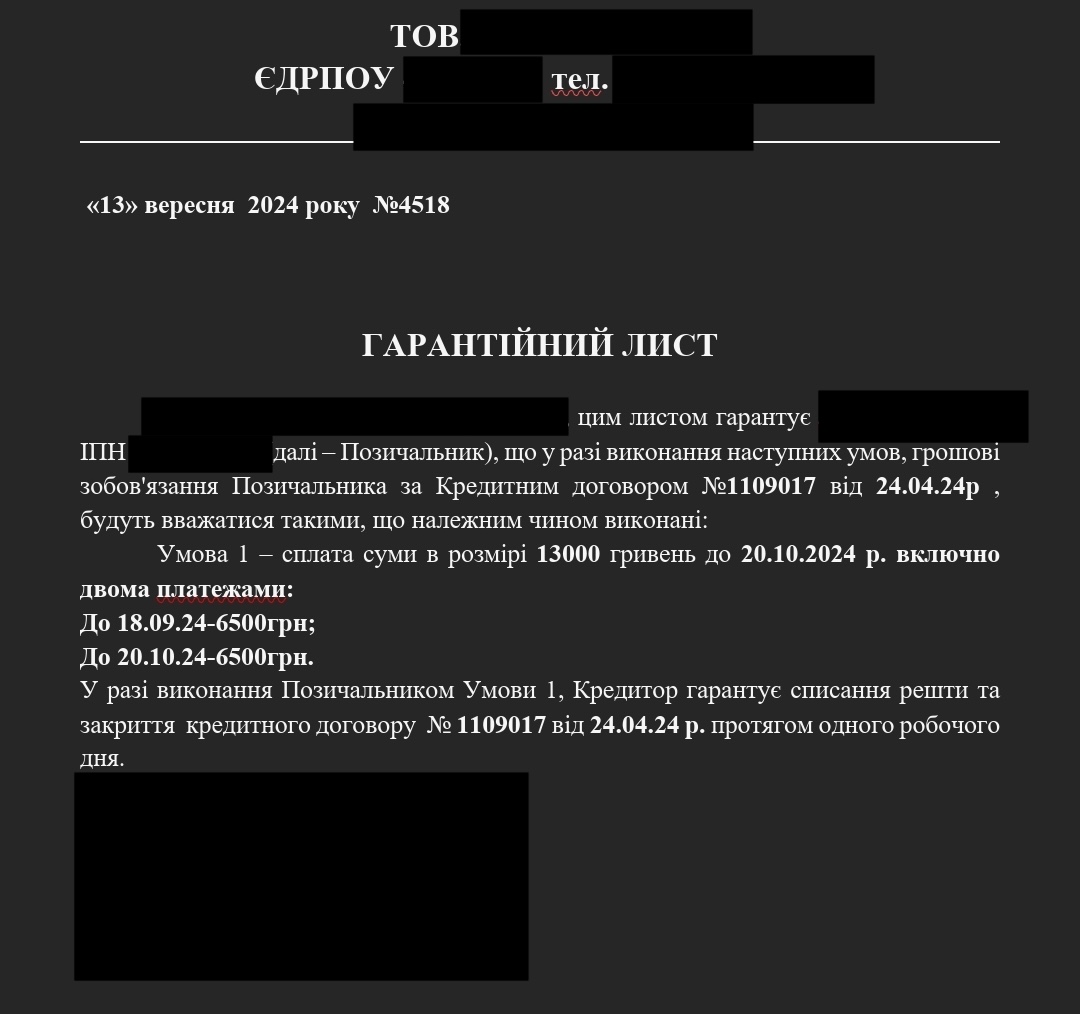

- Obtaining a guarantee letter confirming the cancellation of accrued interest.

Each stage required thorough legal research, understanding financial regulations, and studying judicial practices. A professional negotiation approach ensured significant financial relief for the client.

Moreover, an essential aspect of this case was protecting the client from psychological pressure exerted by financial institutions. Many banks use aggressive debt collection tactics, which can create additional stress for borrowers. Seeking legal assistance in time helps avoid such situations and find the best resolution.

Why This Decision Was Made

Legitimacy of the client’s claims – violations by the creditor were identified

Effective negotiation strategy – a compromise was reached without court proceedings

Financial benefits for the client – a significant portion of debt obligations was written off.

Questions and Answers

Question

Can an agreement be reached with the bank to reduce the debt?

Answer

Yes, if the creditor violates the law or is open to compromise. In many cases, banks agree to renegotiate debt conditions if the client presents strong legal arguments.

Question

Is it necessary to go to court to review credit terms?

Answer

Not always. Negotiations can yield a quicker and more effective result. Court proceedings take more time and can result in additional costs, so it is often best to attempt a resolution through direct negotiations first.

A well-planned legal approach allows for a significant reduction in credit burdens without court proceedings. Thanks to effective negotiations, the client received guarantees of interest and debt obligation forgiveness. If you are facing a similar problem, seek legal assistance.

Every case requires a tailored approach, and a strategic negotiation process with banks ensures the most favorable outcome. Seeking professional legal support helps avoid unnecessary financial obligations and protect your rights.

Legal assistance in debt burden reduction is becoming increasingly relevant as financial institutions continue to introduce new conditions for borrowers. That is why timely consultation with a lawyer is essential in finding the best solution in a difficult financial situation.