I constantly strive to develop and acquire new knowledge, my experience and additional education confirm this.

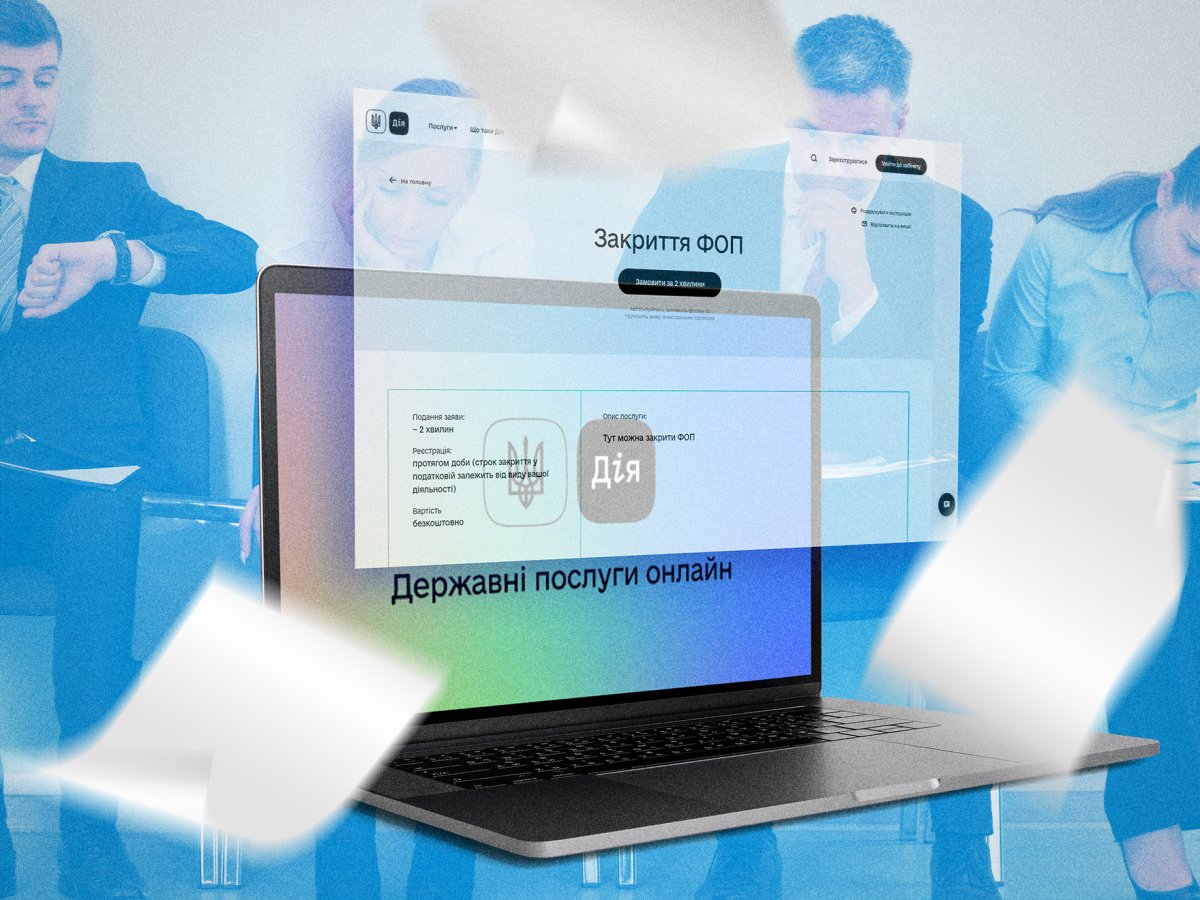

Termination of activity of a natural person-entrepreneur in Ukraine

The activity of an individual entrepreneur in Ukraine is regulated by the legislation on entrepreneurship and tax legislation. NPE is a natural person who carries out business activities without forming a legal entity. In Ukraine, a sole proprietorship can choose different forms of taxation and engage in various types of activities, including trade, services, production, etc.

Termination of the activity of an individual entrepreneur in Ukraine can occur for various reasons, including business reorganization, closing of the enterprise, change of type of activity or lack of entrepreneurial activity.

The main steps to stop the activities of the NPE in Ukraine include:

Preparation of documents:

A sole proprietorship must prepare the necessary documents for termination of activity, including a statement on termination of business activity.

Submitting an application to the registration authorities:

The NPE submits an application to the state registrar to terminate business activities. The application can be submitted in person, through a representative or online through the electronic services portal.

Obtaining a certificate of termination of business activity:

After submitting the application, the state registrar makes a corresponding entry in the Unified State Register of Legal Entities, Individual Entrepreneurs and Public Organizations. An extract from the register on termination of business activity can be obtained in person or downloaded online.

Calculation of tax liabilities:

The NPE must calculate all tax liabilities and pay them before the termination of activity.

Closing bank accounts:

The NPE must close all bank accounts related to business activities. For this, it is necessary to apply to banks with relevant documents.

Submission of reporting:

After the termination of the activity of the NPE, it may be necessary to submit certain reports to the relevant authorities, in particular to the tax inspectorate.

Closing of cases in state bodies:

It is necessary to deregister with the tax inspectorate, the Pension Fund and other state bodies. Submission of reports and other necessary documents.

It is important to take into account that the procedure for terminating the activity of a sole proprietorship may have its own characteristics depending on the specific circumstances and type of activity. It is recommended to seek advice from a legal specialist or tax consultant for detailed information and assistance with this procedure.

Conclusion

The procedure for terminating the activities of a natural person-entrepreneur in Ukraine includes several mandatory steps that help to correctly end business activities and avoid possible legal problems in the future. It is important to carefully perform all the necessary actions and submit the relevant documents to the relevant authorities.

The help of a lawyer can be useful when closing an individual entrepreneur ( NPE) in Ukraine for various reasons. A lawyer can help you prepare all the necessary documents for the closing of the NPE, including statements, declarations, income information and other documents necessary for this procedure. A lawyer can act as your representative before the relevant authorities, such as the State Tax Service or the State Registration Service, and protect your interests during this process.