I am a lawyer, I have more than 5 years of experience in the legal field. I worked at the company, in government agencies and a law firm. I mainly specialize in disputes with government agencies.

Background:

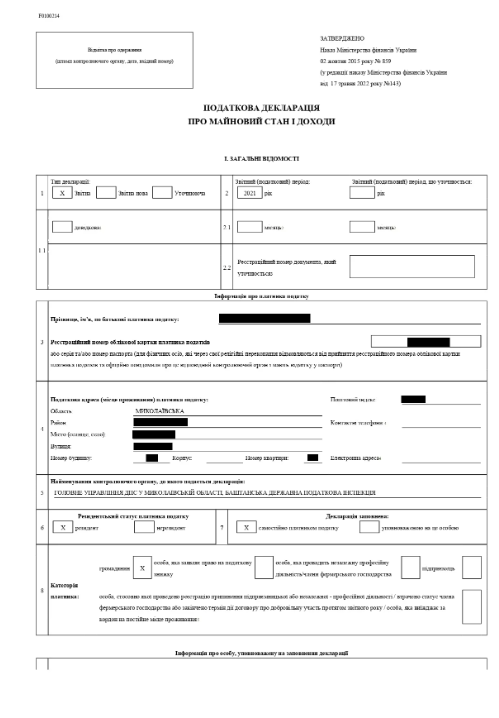

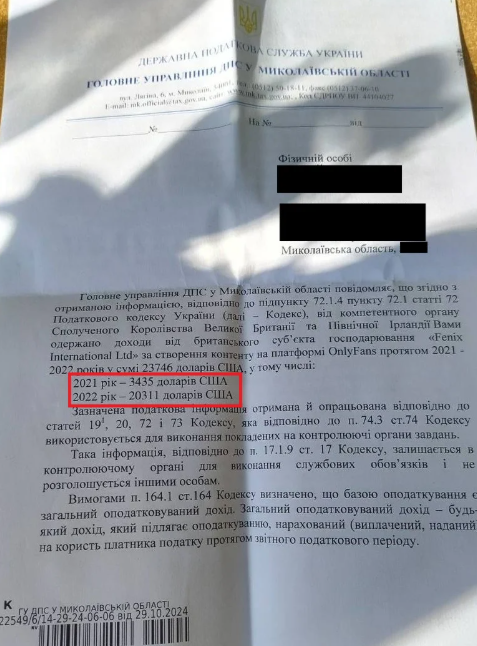

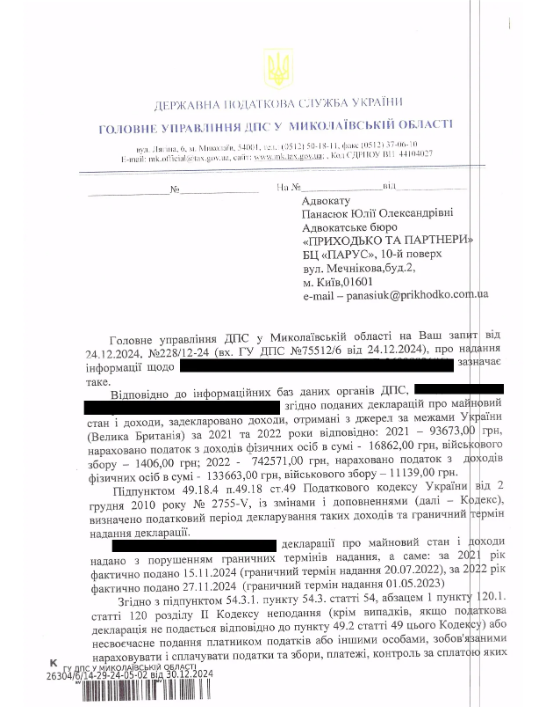

A client — a model earning income on the international platform OnlyFans, operated by the British company Fenix International Ltd, reached out to me. She had received an official letter from the regional office of the State Tax Service of Ukraine (STS) informing her of the requirement to declare income received from abroad.

In the letter, the tax authority:

- informed her of the mandatory filing of a personal income and assets declaration;

- requested bank statements confirming income received from a foreign source;

- warned about a fine equal to one minimum wage in case of failure to respond or improper response;

- mentioned possible additional financial sanctions and penalties for undeclared income.

Problem:

The client had no experience dealing with tax authorities and was unsure how to properly respond to the request and file the declaration. Her main concerns included:

- the risk of being fined;

- additional tax liabilities and penalties;

- the possibility of a tax audit or even a search conducted by the Bureau of Economic Security (BES);

- reputation loss due to disclosure of personal information.

Solution:

As a tax law attorney, I undertook a number of actions to resolve the situation without negative consequences for the client:

- Legality assessment of the request.

The request was reviewed for compliance with the formal requirements of the Tax Code of Ukraine and assessed for the scope of STS authority in this case. - Legal justification and preparation of the response.

An official response to the STS was drafted, which:

- confirmed the fact of receiving foreign income;

- specified the source of funds;

- demonstrated that tax obligations were fulfilled (including personal income tax and military levy).

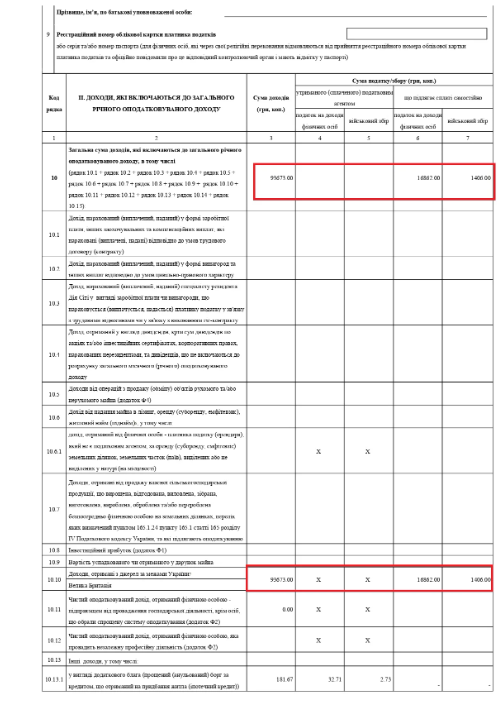

- Tax declaration support.

The annual personal income and assets declaration for the relevant period was submitted through the taxpayer's online account. All calculations were verified and formatted according to Ukrainian law. - Tax payment monitoring.

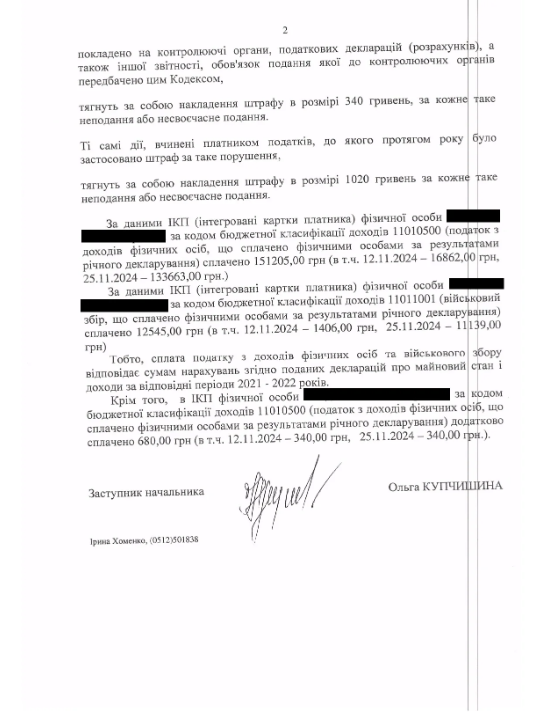

Tax payment was arranged in a timely and correct manner, avoiding penalties. - Receiving official confirmation.

After submitting all documents, the client received an official response from the STS confirming that her tax obligations were fulfilled and no claims would be made.

The client achieved:

- Avoidance of any fines or penalties.

- Official confirmation from the tax authorities of no outstanding tax liabilities.

- The tax matter was resolved administratively with no need for legal or court intervention.

- The client’s reputation and privacy were preserved.

- Full compliance with Ukrainian legal requirements for declaring foreign income was ensured.

Result:

The client’s tax situation was resolved quickly, professionally, and without legal consequences. No further audits, summonses, or searches occurred.

Are BES searches possible in such cases?

This is a common concern among individuals receiving income from abroad. However, in this case — as in many similar ones — no actions were taken by the Bureau of Economic Security. On the contrary, proper documentation and timely income declaration are the best ways to avoid unwanted attention from law enforcement agencies.

This case proves that with the right legal support, it is possible to resolve foreign income declaration issues safely and lawfully — even when the source is a non-standard platform like OnlyFans.

Timely consultation with a specialist helps avoid fines, tax complications, and protects the interests of individuals in sensitive legal situations.