Forbes-recognized counsel and architect of the COMPASS framework, a strategic breakthrough for navigating international investments and business expansion, with over 5 years of experience in corporate law, including investment management, VC/PE, and cross-border transactions, contributing $15B+ in transactions across diverse sectors.•

Entry of Ukrainian Business into the US Market: Legal Support Case by Miraziz Khidoyatov

In 2024, a Ukrainian team specializing in eco-friendly packaging and logistics decided to enter the US market. The founders saw the American market not only as a source of potential customers but also as an opportunity to attract strategic partners for scaling. The growing demand for sustainable solutions and increased awareness of environmental practices in the US were key factors behind this decision.

To implement their plan, the entrepreneurs turned to attorney Miraziz Khidoyatov — an expert in international corporate and tax law who specializes in supporting Ukrainian and Eastern European businesses in the US. Khidoyatov's team had already helped dozens of companies from the region establish a legal and compliant presence in North America.

The main objective was to create a legal and tax structure that would enable the company to operate lawfully in the US, minimize fiscal risks, and retain control over the corporate structure. It was also necessary to prepare the business for potential interest from investors — especially US-based funds that support sustainable startups.

Following strategic consultations, the state of Delaware was selected for its favorable corporate laws and transparent registration process. The flexibility of Delaware’s legal framework and its well-established case law make it an ideal jurisdiction for building a scalable and investor-attractive structure.

Case Overview

Attorney Khidoyatov conducted a business model audit and analyzed the legal and tax implications of two options: LLC and C-Corp. Considering the company's goals — working with US distributors, accessing logistics infrastructure, and attracting venture capital — the C-Corp structure in Delaware was chosen. This model provided flexibility in equity distribution and simplified the path to investment.

Key Implementation Steps

1. Choosing Jurisdiction and Company Type

Legal documents were prepared and submitted at both the state and federal levels:

- Company registered with the Delaware Division of Corporations.

- EIN (Employer Identification Number) obtained from the IRS.

- A registered agent was appointed in Delaware for regulatory compliance.

- Tax reporting system configured in accordance with federal and state regulations.

All procedures were completed remotely using digital signatures, without the physical presence of the founders in the US.

2. Opening a Bank Account and Drafting Contracts

With the help of a fintech platform linked to a US bank, a corporate account was opened. In addition:

- Custom NDAs and distributor agreements were prepared according to US standards.

- A Master Service Agreement (MSA) was developed for B2B cooperation with US clients.

- Privacy Policy and Terms of Use adapted to US legislation.

- A cross-border payment system was set up between the Ukrainian parent company and the US subsidiary.

Case Results

- Successful registration of C-Corp in Delaware with full compliance.

- Remote EIN acquisition and tax system configuration.

- US bank account opened and invoice system implemented.

- First contracts signed with US logistics and retail partners.

- Company structure tailored to venture capital requirements.

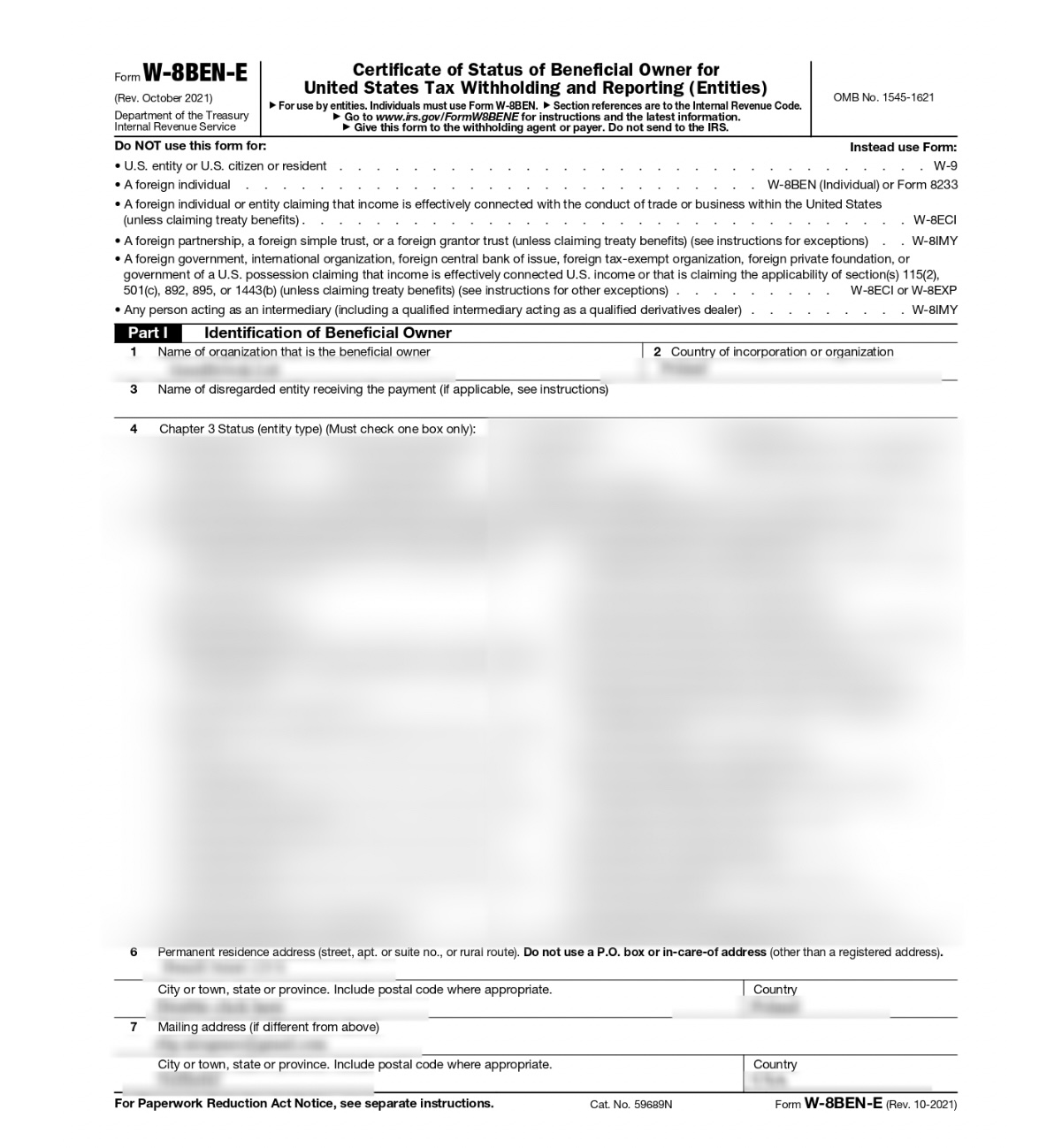

Proof of Form W-8BEN-E Completion Stage

Frequently Asked Questions

Can I open a company in the US without a visa?

Yes, Ukrainian citizens can register a company in the US remotely. To conduct business physically in the US, a business visa may be required, but registration and banking processes can be completed online.

Which structure should I choose — LLC or C-Corp?

C-Corp is better suited for raising investment and scaling, especially in tech or export-related projects. LLCs are simpler to manage but may face limitations with venture capital firms.

How long does it take to register a company in Delaware?

Registration typically takes 1–3 business days. Obtaining an EIN takes 1 to 5 days depending on IRS processing times.

What taxes does a company pay in the US?

The federal corporate income tax is 21%. Additional state taxes may apply. It’s also important to consider international tax treaties and transfer pricing regulations.

Legal support from attorney Miraziz Khidoyatov enabled the Ukrainian company to enter the US market efficiently and lawfully. Thanks to a well-structured approach, all regulatory requirements were met, and a foundation was laid for future growth and investment. This case proves that with the right strategy, Ukrainian businesses can confidently scale internationally.