Lawyer, specialist in the practice of international corporate law, fintech and legal support of businesses in the EU and Asia. A lot of practical experience and successful cases in the portfolio.

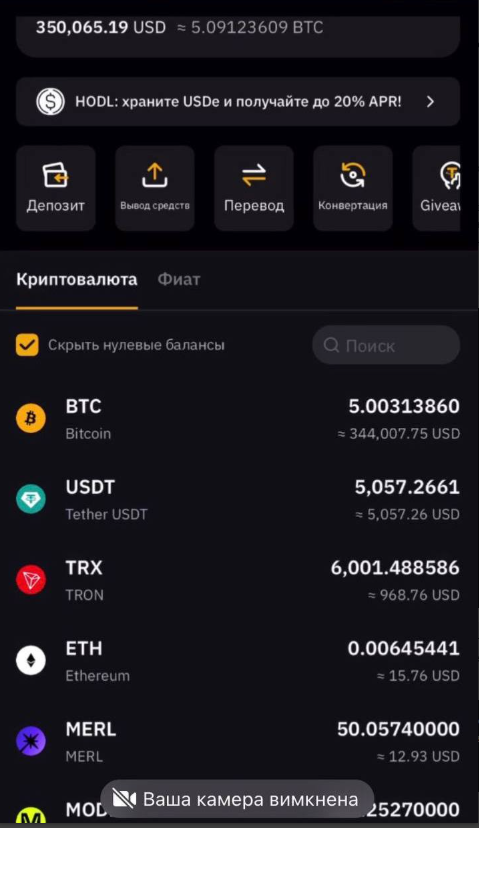

The client contacted our company after 5 Bitcoin and 30,000 USD in the stablecoin USDT were blocked on his account on the ByBit cryptocurrency exchange.

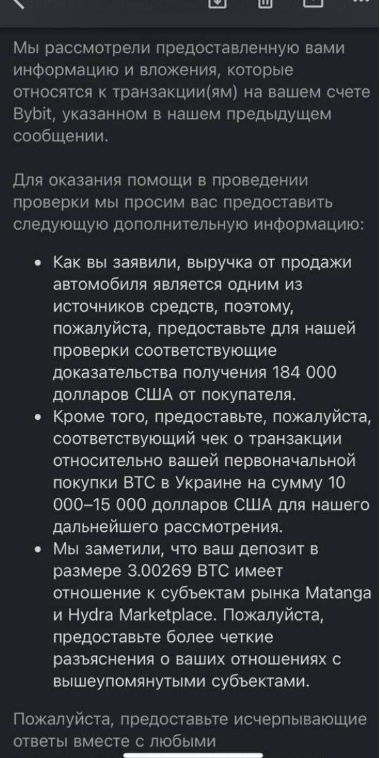

The block occurred due to suspicions from the exchange's compliance service regarding potentially risky activity, which is usually related to violations of financial security norms, anti-money laundering (AML), counter-terrorism financing (CTF), and suspicious connections with dubious crypto exchanges.

This situation is quite common among crypto investors, as cryptocurrency, despite its popularity, remains a fairly risky tool due to its anonymity and lack of clear regulation in many countries.

What is Cryptocurrency?

Cryptocurrency — these are digital or virtual currencies that use cryptography for security. Unlike traditional currencies, cryptocurrencies do not have a central issuer or authority controlling them, and most of them operate on the basis of blockchain technology.

Blockchain is a distributed ledger that records all cryptocurrency transactions that cannot be altered or falsified. This technology ensures a high level of security and transparency.

The most popular cryptocurrencies include Bitcoin, Ethereum, Ripple, Litecoin, Tether (USDT) and others. Cryptocurrencies are used for various purposes, such as investments, payments for goods and services, and as a means of storing or accumulating value. However, due to their anonymity and lack of centralized control, they have become attractive for use in illegal transactions.

Legalization of Cryptocurrencies in Ukraine

In many countries around the world, the status and use of cryptocurrency are ambiguous, especially in connection with regulatory issues and combating money laundering. In Ukraine, the situation with cryptocurrency is also undergoing changes.

Until recently, cryptocurrencies in Ukraine did not have clear legal regulation, but in light of the growing interest in this sector, the government started working on creating a legislative framework to regulate this market. Ukraine has taken several important steps towards the legalization of cryptocurrencies, including legislative initiatives and tax changes. In particular, in 2021, the Verkhovna Rada of Ukraine passed the law "On Virtual Assets," which recognizes cryptocurrency as virtual assets, which can be used for investments, trading, and other legal operations.

According to the new legislation, cryptocurrencies in Ukraine are recognized as legal property, and their circulation within the legal framework is allowed. Requirements for the registration of cryptocurrency exchanges have been established, as well as certain regulations for companies dealing with the processing and storage of cryptocurrency assets, in order to comply with AML (anti-money laundering) and CTF (counter-terrorism financing) rules. These changes allow Ukrainian citizens and businesses to work with cryptocurrency without breaking the law, while also ensuring the protection of the rights of investors and cryptocurrency service users.

Why Are Accounts Blocked on Crypto Exchanges?

Blocking cryptocurrency accounts on exchanges, such as ByBit, can occur for several reasons. The most common reason is suspicion regarding the illegitimacy of the user's assets. Exchanges, particularly ByBit, actively fight money laundering and fraud, requiring their clients to comply with a range of rules to ensure transparency and security of transactions.

One of the main tools for combating illegitimate activity is the verification of users and their activities.

Exchanges may block accounts if:

- Suspicion of illegal origin of funds: If the exchange suspects that the cryptocurrency was obtained through illegal or dubious sources.

- Connections with suspicious crypto exchanges: Many cryptocurrency exchanges and platforms have a negative reputation due to their involvement in fraudulent schemes or illegal activities.

- Violation of AML/CTF rules: Exchanges often check accounts for compliance with anti-money laundering and counter-terrorism financing requirements.

In this case, users must confirm the source of their funds, explain their connections with other cryptocurrency platforms, and provide all necessary documents to unblock their account.

How We Helped the Client Resolve the Situation

Our team was able to quickly and efficiently resolve the client's issue with the blocking of their account on ByBit. We began by thoroughly reviewing all of the client's financial transactions and gathering the necessary documentation to confirm the legitimacy of their cryptocurrency assets. Here’s what was done:

- Gathering and systematizing supporting documents: We worked on creating a set of documents, including bank statements, tax returns, and other documents that confirm the source of the funds.

- Formulating explanations and justifications: Our lawyers prepared a clear explanation confirming that the client's cryptocurrency had no connection to dubious exchanges and that all transactions were made in accordance with legal requirements.

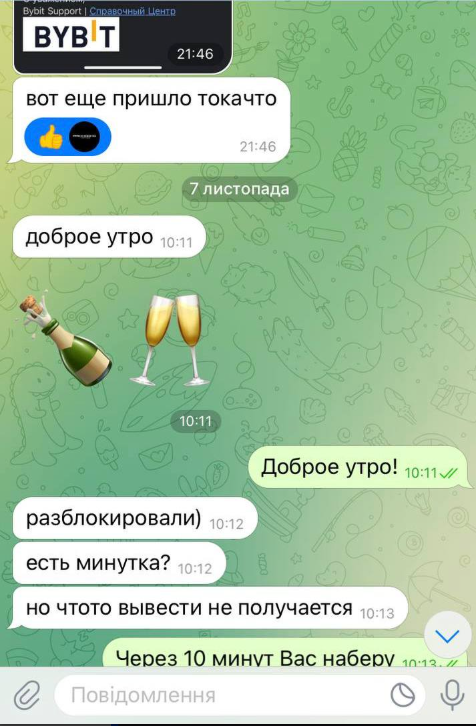

- Transparent communication with ByBit's compliance department: We organized continuous communication with the exchange’s compliance department, responding to all their inquiries and providing the necessary clarifications.

As a result, just 4 days after the cooperation started, the client’s account was fully unblocked. The client regained the ability to freely manage their assets and preserved their reputation on the ByBit exchange.

Thanks to our legal support, the client was able to successfully resolve the complicated situation of having their cryptocurrency account blocked. We helped demonstrate the legitimacy of the transactions and ensured full protection of their interests. Such situations highlight the importance of complying with AML/CTF requirements and the value of proper legal support when dealing with cryptocurrency assets.