А highly qualified specialist who combines deep expertise in two strategically important areas: the cryptocurrency industry and international corporate law. In the field of blockchain technologies and cryptocurrencies, with over five years of practical experience, he specializes in issues of unlocking cryptocurrencies, cryptographic security, tokenization of business processes, and conducting investigations related to cryptocurrency transactions.

The client contacted our company after 0.7 Bitcoin (equivalent to approximately $65,000 USD at the current exchange rate) was frozen during an attempt to exchange it for the stablecoin USDT via a specialized crypto exchange platform.

The situation developed in a typical way for cryptocurrency operations: the client received the funds in their own wallet and decided to exchange them via a verified exchange service offering a favorable rate and promising quick processing. However, immediately after sending the Bitcoin to the exchanger's address, the client received a notification stating that the transaction had been temporarily frozen.

The platform justified its actions by activating internal verification procedures in accordance with AML/CTF (Anti-Money Laundering / Counter-Terrorist Financing) policies. These measures are typically applied to transactions that trigger automatic risk alerts — such as large amounts, unusual user behavior, or crypto sent from addresses already under increased scrutiny.

The exchanger presented the client with a list of requirements:

- provide information about employment status;

- disclose the sources of income from which the crypto capital was formed;

- submit the full transaction history prior to the receipt of funds in the wallet;

- explain the purpose of receiving and further use of the crypto assets;

- provide supporting documents: bank statements, tax declarations, contracts, etc.

Additionally, the situation was complicated by the exchanger’s requirement for KYC verification not only by the client but also by the sender of the cryptocurrency that was received in the wallet. In most cases, this is technically or legally impossible, especially if there were intermediaries between the parties or the transfer was made anonymously.

What is AML/CTF and why is it important?

AML (Anti-Money Laundering) and CTF (Counter-Terrorist Financing) are international standards requiring financial institutions and crypto platforms to conduct checks to detect potentially illegal activity. According to regulatory norms, crypto exchanges may suspend transactions until full identity verification and confirmation of the origin of assets.

Such situations are becoming increasingly common due to growing regulatory pressure on the crypto industry worldwide, especially after numerous scandals and market abuses.

How did we help the client?

Our team promptly took control of the situation. We conducted a legal analysis, reviewed the terms of the exchange service, and developed a clear response strategy.

The following steps were taken:

- A complete document package was prepared, including:

- detailed client information (profession, workplace, country of tax residency);

- proof of legal origin of funds (bank statements, payment orders, contracts with partners, etc.);

- chronology of previous transactions — the path of each Bitcoin to the wallet;

- explanation of the transaction purpose and further use of the funds (e.g., property purchase, investment in own business).

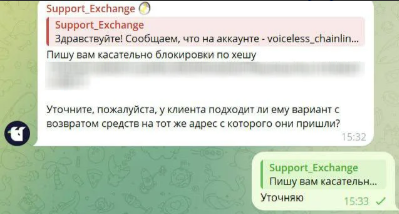

- Established direct communication with the support and security department of the exchange for expedited documentation approval.

- Prepared a legal position on the justification of the freeze and potential risks of unjustified fund retention.

- Held negotiations on alternative verification methods for the sender, considering the protection of confidential information.

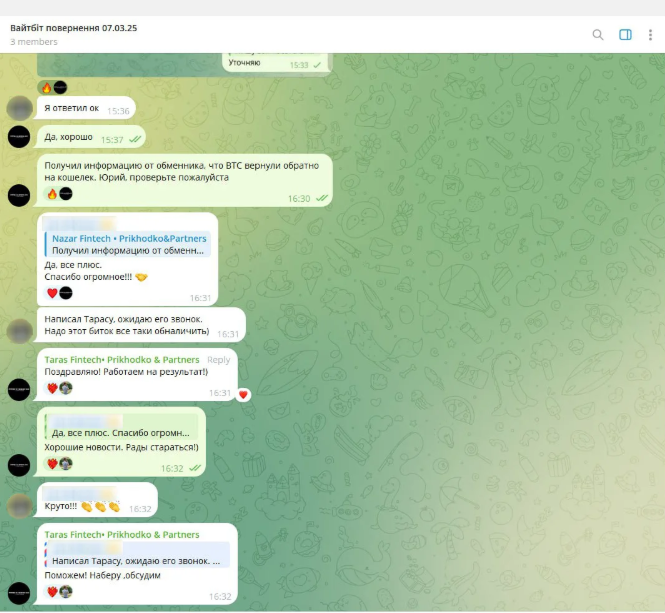

Result

By the third day after the client’s request, all documents were approved, doubts about the legality of the funds' origin were resolved, and the exchange fully unblocked the transaction. The client regained access to their 0.7 BTC and was able to proceed with the exchange to USDT without further obstacles.

Such cases demonstrate the importance of having professional support when dealing with crypto services, especially in cases of fund blocking. Thanks to a deep understanding of AML/CTF procedures, transaction verification specifics, and legal nuances, we effectively protected the client's interests, avoiding lengthy disputes and asset losses.

🔹 Working with crypto and need legal support or guidance?

Reach out — we will ensure complete security for your transactions.