А highly qualified specialist who combines deep expertise in two strategically important areas: the cryptocurrency industry and international corporate law. In the field of blockchain technologies and cryptocurrencies, with over five years of practical experience, he specializes in issues of unlocking cryptocurrencies, cryptographic security, tokenization of business processes, and conducting investigations related to cryptocurrency transactions.

Initial Data: A client — an experienced crypto trader operating in the cryptocurrency market with assets such as USDT, BTC, and ETH — approached us. His business model involved attracting investments from private individuals and managing their assets in trust to generate profits through trading strategies.

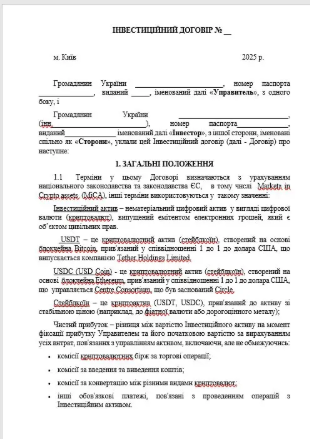

Due to the growing volume of operations and plans for scaling activities and attracting foreign investors, the client needed a reliable legal tool — a comprehensive investment agreement that takes into account the specifics of working with cryptocurrencies amid legal uncertainty both in Ukraine and in most jurisdictions.

CHALLENGES

- Lack of legal framework in Ukraine regarding the status of virtual assets, mechanisms for trust management of crypto assets, and investor protection.

- Absence of unified international practice, requiring adaptation of the agreement for potential multi-jurisdictional use.

- High AML/KYC risks, especially when dealing with large sums and non-residents.

- Need to balance the interests of the parties — both the manager (trader) and the settlor (investor), minimizing the risk of disputes, misunderstandings, or fraud accusations.

The AML/KYC sphere is a system of measures used to prevent financial crimes such as money laundering, terrorist financing, and other illegal activities through banking or cryptocurrency transactions.

WHAT WE DID

We began with researching the client’s business model, operational processes, reporting, investment attraction channels, asset management methods, and the profile of future investors. Then we analyzed current trust management practices in the crypto space — in both regulated and semi-regulated jurisdictions (Singapore, Estonia, UAE, United Kingdom).

Based on the collected data, we:

✅ Developed the structure of the agreement, which includes:

- The subject of the agreement — transfer of crypto assets under trust management;

- Rules for trading, management, accounting, and asset return;

- Reporting procedure — monthly reports with digital signature, dashboard, and access to a personal account with trading history.

✅ Defined the financial terms:

- Profit distribution mechanism (70% to the investor, 30% to the trader);

- Payout terms — monthly or at the end of the investment period;

- Asset conversion algorithm in case of market fluctuations.

✅ Outlined the risk management approach:

- Disclaimer of guaranteed profitability;

- Investor’s consent to potential losses;

- Limits on allocating assets to high-risk instruments.

✅ Provided for the possibility of early termination of the agreement by mutual consent and outlined dispute resolution mechanisms, including arbitration (in a jurisdiction chosen by the investor).

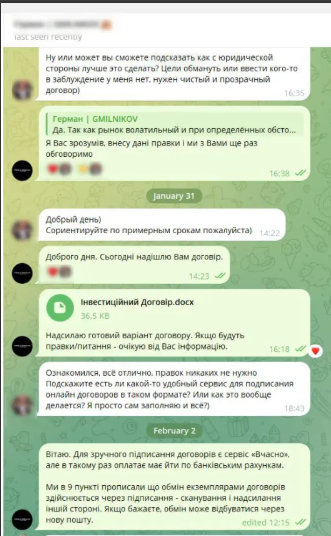

✅ Formulated a strong communication component:

- Use of secure communication channels (Signal, ProtonMail);

- Recording of all communications in the form of screenshots or logs;

- Regular provision of analytics and trading reports.

RESULT

As a result of our work, the client received a comprehensive, well-structured investment agreement designed for both Ukrainian and foreign investors, which:

- Takes into account the specifics of the crypto market;

- Ensures transparent interaction between the parties;

- Minimizes legal risks;

- Is ready for future integration into legal structures (e.g., tokenization of shares, registration of a trading company in UAE or Estonia).

🔹 Working with cryptocurrency, planning to attract investors or launch your own crypto fund?

Contact us — we will prepare not just a contract, but a foundation for scaling your business.