My name is Maria Vetinchuk. I am a lawyer from Kyiv. Key areas of law are international corporate law and fintech. Deep analysis and individual approach allow me to solve your issues quickly and efficiently.

Goal: Assist a Ukrainian entrepreneur in successfully registering an IT company in Spain, ensuring full legal, financial, and administrative support in accordance with local laws. This included market analysis, choosing the legal form, opening a bank account, tax registration, notarization, and registration with all necessary Spanish state authorities.

About the client:

- Industry: IT, software development

- Company registration location: Spain (Barcelona)

- Legal status: Non-EU resident

The client aimed to enter the European market, open an office in Barcelona, and begin scaling the business, targeting customers from EU countries.

Project Implementation Stages

1. Business analysis and planning

We began with an in-depth analysis of the Spanish IT market. A detailed business plan was created, considering local specifics, demand, competitors, and the potential client base. It included financial forecasts, justification for choosing Barcelona as the optimal location, and a marketing strategy for the first 12 months of operation.

2. Choosing the company structure

We recommended registering a Sociedad Limitada (SL) — equivalent to a limited liability company. This form is ideal for small and medium-sized businesses, offering flexible management, easy investor involvement, and limited founder liability.

3. Obtaining NIE (Foreign ID Number)

We prepared documents and assisted the client in obtaining a NIE (Número de Identificación de Extranjero) — a mandatory number for any legal actions in Spain. It's required for opening a bank account or registering a company.

4. Reserving the company name

We submitted a request to the Central Commercial Registry of Spain (Registro Mercantil Central) to check and reserve a unique company name. After approval, the client received a certificate for use of the name.

5. Opening a corporate bank account

We facilitated opening a bank account in one of Spain’s leading banks under the future company’s name. The minimum share capital required for an SL — 3,000 euros — was deposited.

6. Drafting the corporate documents and notarization

We drafted the company charter, minutes of the founding meeting, and other legal documents. Notarization was arranged, including a certificate confirming the share capital deposit. The notary officially certified the establishment of the company.

7. Registration with the Spanish Commercial Registry

All documents were submitted to the Registro Mercantil. Within a few days, the company was officially registered and ready to begin operations.

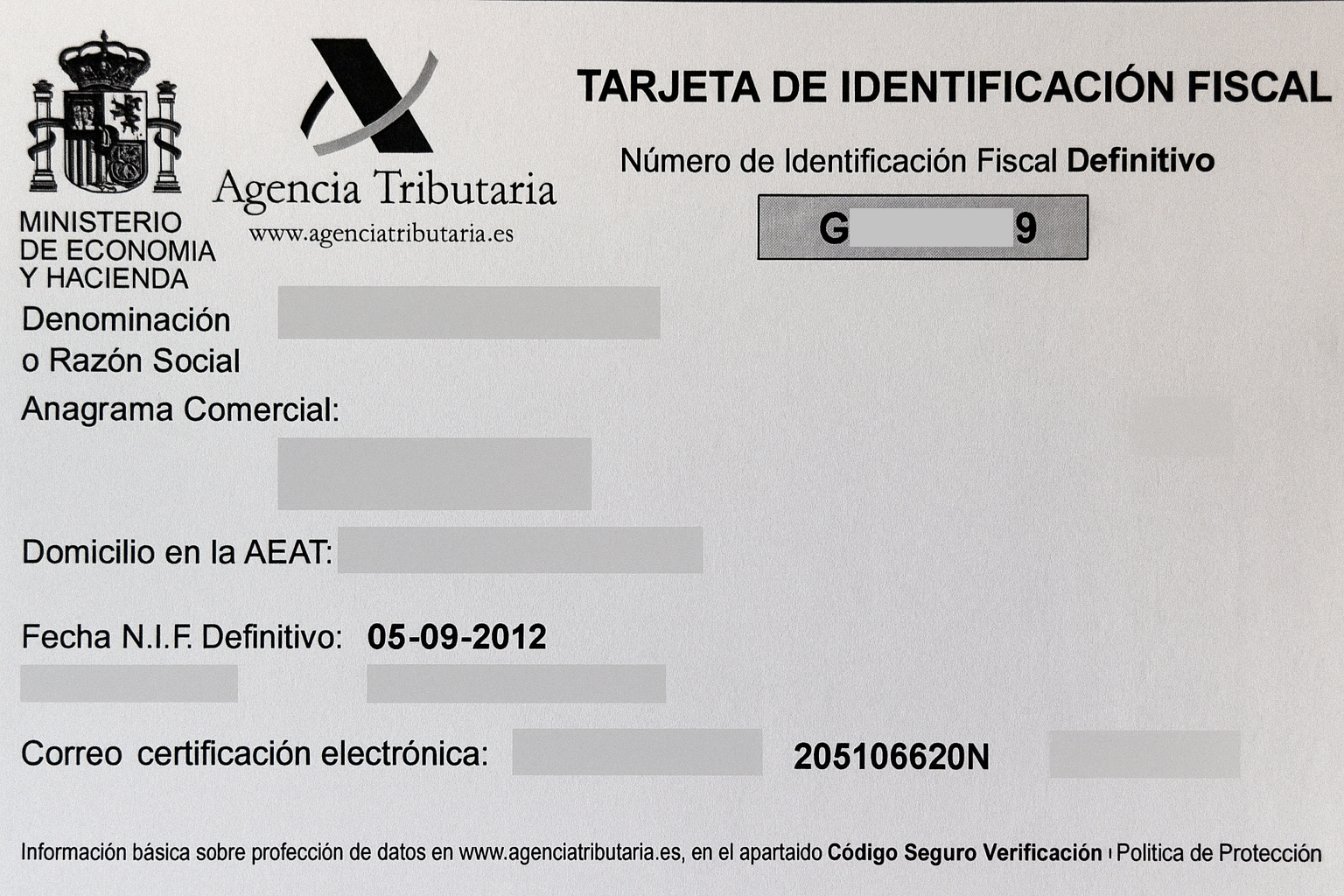

8. Tax Identification Number (CIF)

We obtained a CIF (Código de Identificación Fiscal) — the tax code required for accounting, VAT payments, and conducting commercial activities.

9. Registration with the Social Security system

We registered the company as an employer, enabling it to officially hire employees, pay social contributions, and comply with Spanish labor laws.

Result:

Thanks to a clear action plan, professional legal support, and effective communication with Spanish authorities, the client successfully launched their IT company in Spain. After opening an office in Barcelona, the first team was formed, contracts with partners were signed, and sales began. Within the first 3 months, the company reached profitability and secured several major clients from Spain and the Netherlands.

Registering a company in Spain as a non-resident requires detailed planning, knowledge of local laws, and experience dealing with public institutions. This case demonstrates how professional legal support enables a fast, secure, and successful market entry.

🔹 Planning to start a business in Spain or the EU? Contact me — I will develop a personalized strategy for your project and provide full support until launch.