My name is Maria Vetinchuk. I am a lawyer from Kyiv. Key areas of law are international corporate law and fintech. Deep analysis and individual approach allow me to solve your issues quickly and efficiently.

Client: A representative of the Ukrainian branch of a European holding company, whose ownership structure includes entities registered in the Netherlands and Cyprus. The main company, registered in the Netherlands, specializes in trading animal-based products and actively exports to EU countries. In light of expanding logistics routes, the company made a strategic decision to establish a transit zone in Romania, which is conveniently located for Eastern European trade operations.

Project Objective

The main tasks included:

- Obtaining a VAT number (registration as a VAT payer) in Romania;

- Opening a corporate bank account in a Romanian bank, required for financial transactions related to goods transit;

- Ensuring full compliance of documentation with Romanian tax legislation and banking system requirements.

The project required a comprehensive legal approach, considering the cross-border structure of the company and a high level of responsibility toward regulatory authorities.

VAT number in Romania is a registration number for value-added tax (TVA - "Taxa pe Valoarea Adăugată") assigned to companies or individual entrepreneurs conducting taxable commercial activities within Romania.

Challenges

Although Romania is one of the more accessible EU countries in terms of tax registration, this case presented several challenges:

- Complex ownership structure, involving legal entities from the Netherlands and Cyprus, as well as an operational unit in Ukraine.

- No permanent presence in Romania, which required delegating authority to local representatives and issuing powers of attorney in compliance with Romanian law.

- Strict KYC requirements by banks (Know Your Customer), due to the international nature of the holding and the type of goods (animal-based products — subject to increased regulatory scrutiny).

- The need to justify the business purpose for VAT registration, including logistical reasoning behind choosing Romania as a transit point.

Our Approach

We provided full legal support for the project from A to Z — from initial risk assessment to obtaining all permits and opening the bank account:

- Legal audit of the client’s structure, including a review of incorporation documents of the Dutch and Cypriot companies to ensure compliance with Romanian regulatory standards.

- Preparation of a business model justification, including logistics planning, product categorization, transit schemes, and financial flow mapping.

- Drafting powers of attorney and appointing local representation, which enabled smooth interaction with Romanian authorities without the need for physical presence of company owners or directors.

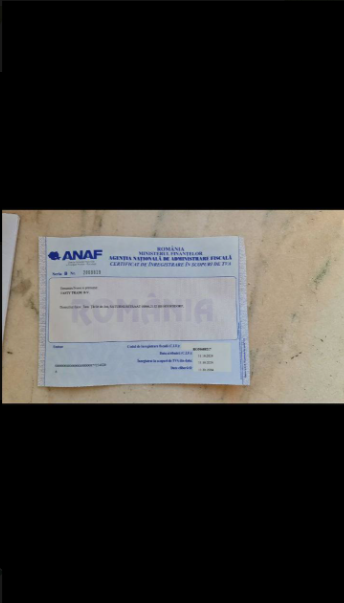

- Support with VAT registration — preparation and submission of the application, document translation, communication with ANAF (Romanian National Agency for Fiscal Administration).

- Preparation of a complete documentation package for the bank, including financial statements, corporate structure, business activity description, and KYC questionnaires — which helped pass the compliance process successfully.

Result

VAT number in Romania obtained, allowing the client to officially conduct import, export, and transit operations across the EU.

Corporate bank account opened in Romania, compliant with international banking standards and enabling efficient financial operations with counterparties.

The entire project was implemented without the physical presence of the beneficiaries in Romania, thanks to careful legal planning and properly executed authorizations under Romanian law.

Legal Value of the Case

This case clearly illustrates the importance of involving experienced legal professionals in matters involving international corporate structures, cross-border tax registration, and compliance with multi-jurisdictional regulations. Thanks to a structured and strategic approach, the client not only avoided typical pitfalls but also successfully and legally integrated the Romanian element into the broader EU logistics system of their business. This has unlocked new opportunities for supply chain scaling, tax optimization, and enhanced competitiveness within the European market.

🔹 Planning tax registration in the EU or opening an international bank account? Contact us — we’ll develop a tailored solution based on your business specifics and target jurisdictions.