I am a lawyer, I have more than 5 years of experience in the legal field. I worked at the company, in government agencies and a law firm. I mainly specialize in disputes with government agencies.

Background:

A client – a Ukrainian company engaged in wholesale trade with a significant volume of monthly business transactions – contacted me. At the time of the request, the company had long been classified as a risky taxpayer, which negatively affected its operations. All tax invoices were automatically blocked, and the tax authorities referred to point 8 of the risk criteria.

Due to the invoice blocking, the company was losing contractors, incurring losses, and was unable to operate fully.

Problem:

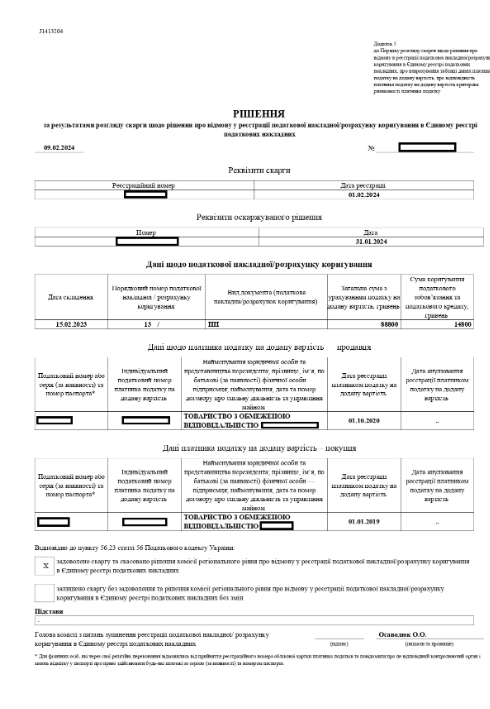

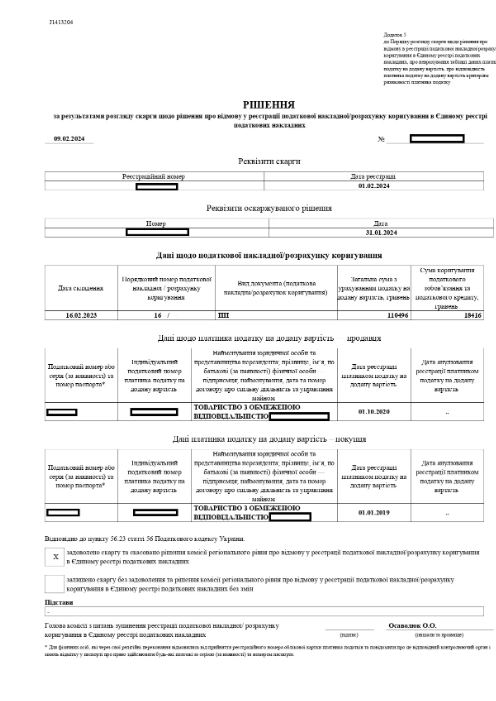

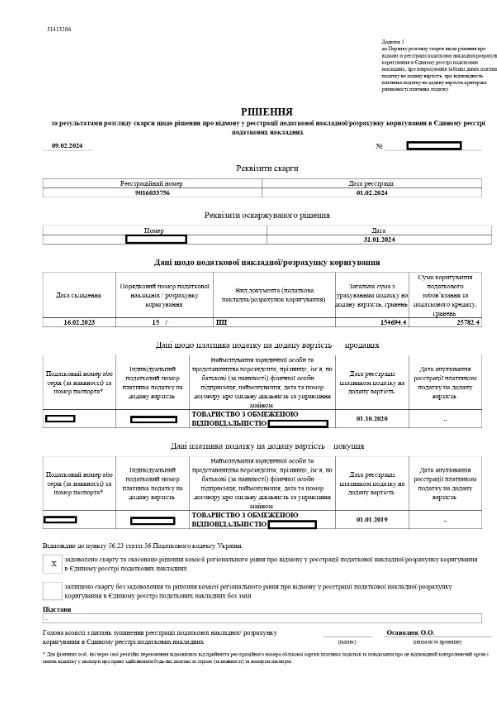

The company received a series of decisions denying the registration of tax invoices without any clear justification or specific list of violations. The tax authority ignored the explanations and documents provided, as well as the evidence of the transactions’ reality.

The core issue was the constant retention of the "risky taxpayer" status, which automatically complicated any attempts to prove the legality of the company’s activity. In addition, the time frame for appealing a denial decision was only 10 business days, requiring an immediate response from my side.

Resolved:

I promptly developed a legal defense strategy that included:

- Comprehensive legal analysis of all disputed business transactions.

- Detailed substantiation of the actual delivery, referencing primary documents: acts, tax invoices, waybills, payment orders.

- Constructing a logical chain: purchase → storage → transportation → sale → receipt of funds.

The complaints included a step-by-step breakdown of each transaction, specifically:

- where and from whom the goods were purchased;

- how and where they were stored;

- who handled transportation;

- who the end buyer was;

- which documents confirmed the delivery and financial settlements.

Special attention was given to evaluating the motivational part of the tax authority’s decisions: in most cases, they simply copied standard wording without analyzing the company’s specific situation. This allowed me to strengthen the position by referencing court practice and provisions of the Tax Code of Ukraine regarding the obligation to provide reasoning.

Additional actions were also taken:

- Preparation of a complete set of complaints to the State Tax Service of Ukraine, considering all formal requirements;

- Submission of additional requests demanding review of the risky taxpayer status;

- Informing contractors about the company’s legal position and protection strategy.

Outcome for the client:

The client received an effective legal strategy, which allowed them to protect their interests without going to court.

All submitted complaints were reviewed by the STS within the statutory deadlines. As a result, positive decisions were issued, and the tax invoices were registered. The company regained the ability to confirm the tax credit for its contractors, easing tensions in business relations.

The company also stopped receiving new registration refusals, indicating that the tax authority effectively ceased blocking activity.

Result:

- All tax invoices were registered without the need to go to court.

- The risky taxpayer status was reviewed and revoked.

- The company returned to normal business operations.

- Its business reputation was preserved and trust with partners restored.

- Potential financial losses amounting to hundreds of thousands of hryvnias due to unrecognized tax credit were avoided.

Timely legal intervention, a well-structured evidence base, and professional communication with the controlling authority allowed not only the revocation of risky taxpayer status but also the full restoration of the company’s tax stability. This case demonstrates that even in complex tax situations, positive results can be achieved without court proceedings when actions are taken clearly, promptly, and professionally.