I am a lawyer, I have more than 5 years of experience in the legal field. I worked at the company, in government agencies and a law firm. I mainly specialize in disputes with government agencies.

Background:

A client contacted our law firm — a company engaged in the distribution of consumer goods. The company conducted monthly business transactions with a large number of counterparties and had a stable turnover. However, due to changes in the approach of the State Tax Service of Ukraine to taxpayer analysis, the enterprise fell under the automatic risk monitoring system.

As a result, the tax authority blocked one of the tax invoices that was supposed to be registered in the Unified Register of Tax Invoices. This document confirmed the delivery of a significant amount of goods to one of the key counterparties. The suspension of the tax invoice registration meant that the counterparty lost the right to a tax credit, which put the future of the partnership at risk. For the client’s company, this could have meant the loss of a business partner and trust from other contacts, as well as potential financial claims and demands to return previously paid amounts.

Problem:

The blocking occurred due to the automatic triggering of point 8 of the risk criteria approved by the STS. This meant that the company or the transaction itself was flagged by the internal algorithms of the tax authority as potentially fictitious. In such cases, the STS sends a request for explanations and documents to confirm the legitimacy of the business transaction.

The client had no experience handling legal correspondence with tax authorities in such situations and did not know which documents to submit, how to formulate the explanation, or how to build a legal position. Fearing rejection and increased administrative pressure, the client sought help from a lawyer.

Desired Outcome:

The goal was to quickly lift the blocking and register the tax invoice, as well as develop a strategy to prevent similar situations in the future.

Responsible Attorney:

Yevhen Yasynskyi — a lawyer with many years of experience in tax law, specializing in tax disputes, appeals against STS decisions, and protecting business interests in interactions with regulatory authorities.

Resolution:

Under the leadership of attorney Yevhen Yasynskyi, a step-by-step strategy was developed consisting of several stages:

- Legal analysis of the grounds for blocking.

Analyzed the STS notification and risk assessment algorithms, identified that the reasons for blocking were formal and did not take into account the specifics of the client's business. Contracts, nature of the goods, and supply chain were reviewed separately. - Preparation of a legally substantiated explanation.

A written explanation was submitted clearly describing the transaction circumstances, delivery routes, type of goods, logistics specifics, and confirming the existence of a real warehouse and staff. References were made to current Ukrainian legislation and relevant case law validating similar situations as lawful. - Collection and submission of supporting documents.

The following documents were attached to the explanation:

- contracts with counterparties;

- delivery and acceptance certificates;

- payment documents;

- waybills and shipping documents;

- bank statements;

- scanned copies of product quality certificates.

- Legal support at all stages of the procedure.

The lawyer monitored deadlines for complaint review and maintained correspondence with STS officials to avoid bureaucratic delays or artificial extensions of the process.

The client received:

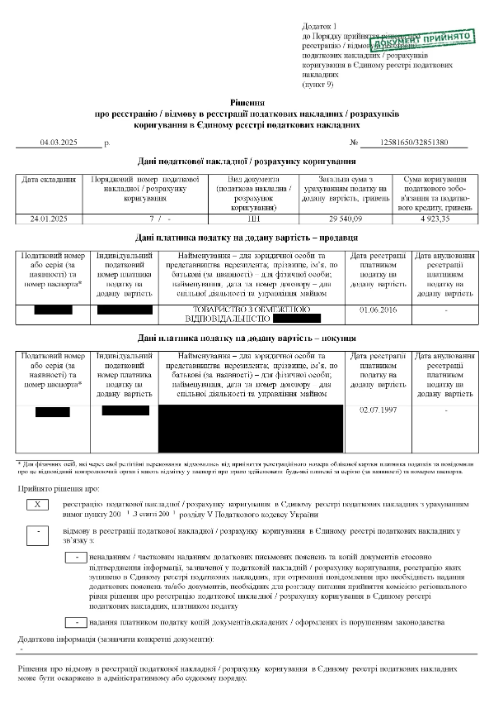

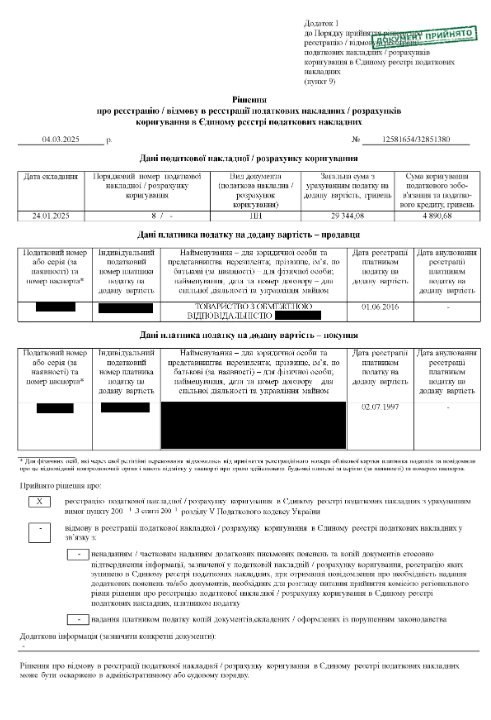

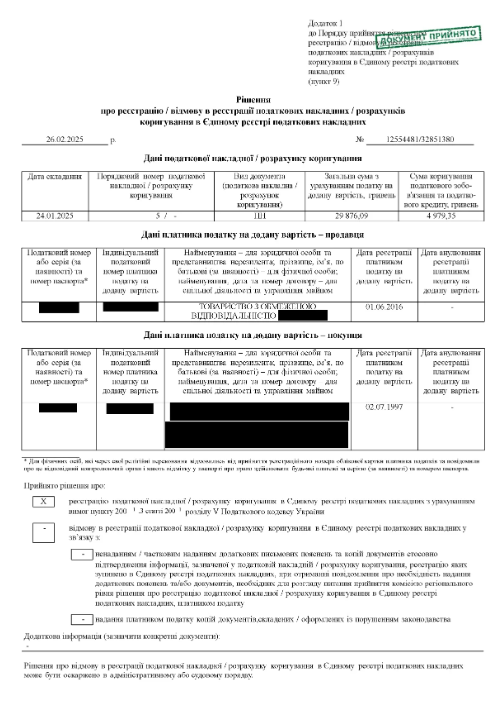

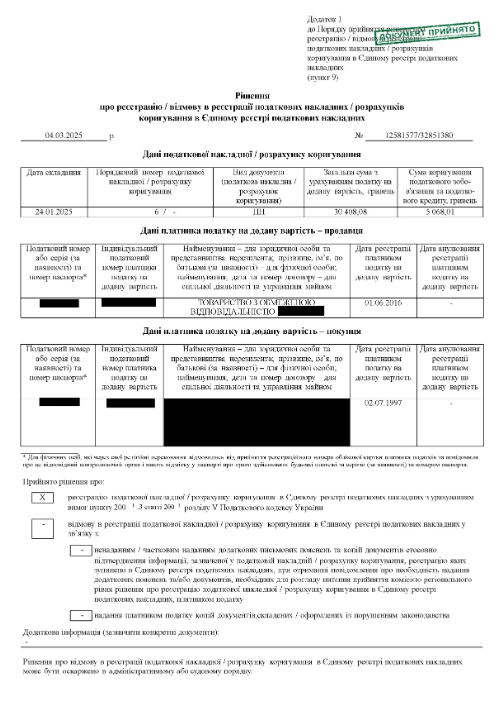

- Official registration of the tax invoice without the need to go to court.

- Restoration of business reputation with the counterparty, enabling further cooperation.

- Financial stability and confidence in the absence of tax risks in the future.

- A comprehensive legal model for responding to similar situations, to be used for future STS inquiries.

Result: After reviewing the submitted explanations and documents, the tax authority issued a positive decision — the tax invoice was successfully registered. The regulatory authority raised no further claims, and the taxpayer's status was not changed to "risky".

This case clearly demonstrates that even in the context of automated tax invoice blocking, a positive outcome can be achieved without litigation if a properly constructed defense strategy is in place.

Thanks to the professional work of attorney Yevhen Yasynskyi, not only was the specific issue resolved, but a strong legal framework was established to prevent similar risks in the future. This ensured business continuity, preserved market reputation, and increased the company’s credibility with partners.