Graduated from Yaroslav Mudryi National Law University in 2015 with a Master of Laws degree. From 2015 to 2023, worked as a legal counsel at a private law firm, specializing in commercial, administrative, and civil cases. Currently (2024–2025) in the process of obtaining a license to practice law as an attorney. Also completed training and internship to qualify as an insolvency practitioner (arbitration manager).

Termination of a case on alleged unregistered business activity: the case of lawyer Alina Rachkovskaya

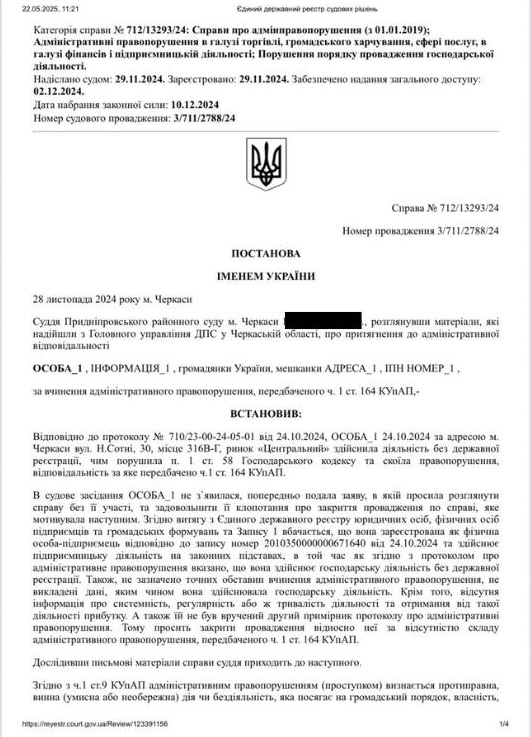

In November 2024, attorney Alina Rachkovska represented a client accused by the tax authorities of engaging in business activity without official registration. The case was heard on November 28, 2024, by the Prydniprovskyi District Court of Cherkasy. According to the tax office, the woman had allegedly sold goods at the Central Market in Cherkasy on October 24 without being registered as a sole proprietor, in violation of Part 1, Article 164 of the Code of Ukraine on Administrative Offenses.

Case Background

The protocol was drafted based on an on-site inspection, yet it contained no concrete evidence of actual commercial activity. The client sought legal assistance from attorney Rachkovska to challenge the legality of the protocol and the imposed charges.

Legal Defense Strategy

1. Proof of Official Registration

- The client was officially registered as an individual entrepreneur (sole proprietor) on the same day — October 24, 2024

- The Unified State Register entry №2010350000000671640 confirmed this registration

- An official extract from the registry was submitted to the court as evidence

2. Critical Analysis of the Protocol

- The protocol did not specify the exact time, type of actions, goods sold, or any evidence of revenue

- There was no indication of regularity — a key element of entrepreneurial activity

- The client never received a copy of the protocol — a significant procedural violation

- The data presented in the document was vague, incomplete, and lacked factual basis

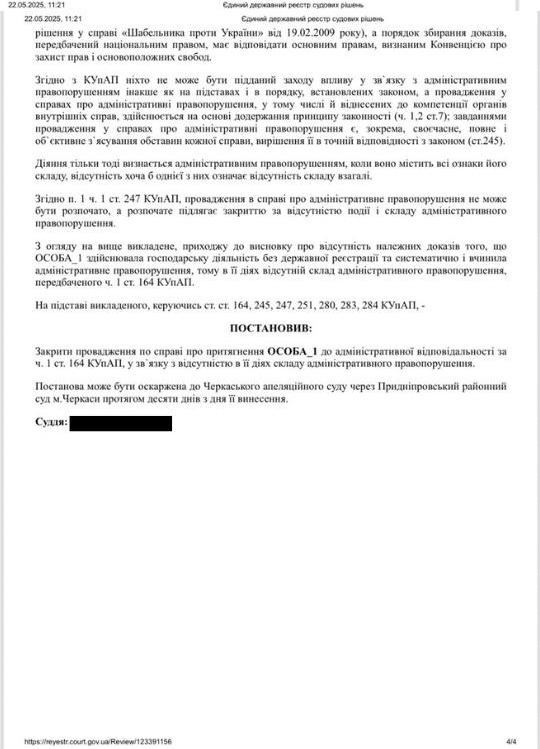

Court Position

3. Court Decision

- The court determined that the tax authority had not provided adequate proof of an offense

- The protocol lacked evidence of commercial regularity, profitability, or the fact of trading

- Procedural violations alone were sufficient to justify closing the case

- Applying the presumption of innocence, the court ruled that the administrative offense was unproven

Case Outcome

- The administrative case was closed

- The court confirmed that no offense had occurred

- The client avoided any administrative penalty

- Attorney Rachkovska’s defense was found to be well-reasoned and legally sound

Frequently Asked Questions

Question

Can registration on the same day as the inspection protect from liability?

Answer

Yes. If official registration occurred on the same day and no regular activity or income was proven — there is no basis for liability.

Question

Why is receiving a copy of the protocol important?

Answer

It ensures the individual’s right to defense. Failure to deliver the protocol violates due process and can justify dismissal of the case.

Legal Conclusion

This case underscores that tax authorities must act strictly within the law and base their accusations on verifiable facts — not assumptions. Attorney Alina Rachkovska built a defense rooted in procedural standards, evidentiary analysis, and assertive courtroom advocacy.

The court’s ruling not only secured her client’s rights but also sent a message to regulatory bodies on the importance of legal precision. The case is a clear example of how qualified legal assistance can successfully protect entrepreneurs even in seemingly complex situations.