I specialize in resolving complex legal issues in the fields of energy, commercial, and administrative law. I combine deep legal expertise with hands-on experience in litigation, contract work, and business support.

Input Data:

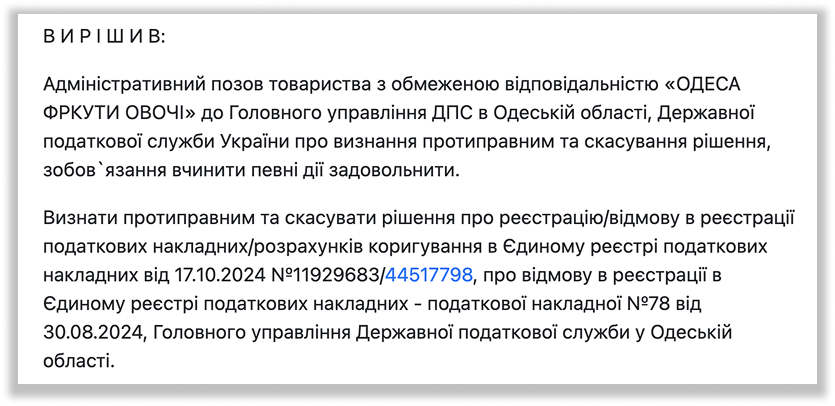

On November 20, 2024, the Odesa District Administrative Court received a statement of claim from Limited Liability Company "ODESA FRUITS VEGETABLES," specializing in economic activities likely related to wholesale trade or production. The Plaintiff sought to declare unlawful and cancel the decision of the Main Directorate of the State Tax Service (STS) in Odesa Region dated October 17, 2024, regarding the refusal to register tax invoice №78 dated August 30, 2024, in the Unified Register of Tax Invoices (URTI). An additional demand was to oblige the State Tax Service of Ukraine to register this invoice with its submission date.

The client's problem lay in the critical blocking of the tax invoice, which is a vital document for any enterprise working with Value Added Tax (VAT). Refusal to register a tax invoice makes it impossible for the counterparty to form a tax credit, leads to losses, disrupts the supply chain, damages reputation, and creates significant obstacles to normal economic activity. For a business, especially in trade where speed and continuity of operations are key, such a refusal is a serious challenge that required immediate and qualified legal intervention.

Problem:

Tax invoice №78 was issued during economic activity, but its registration in the URTI was suspended by the tax authority on the grounds of compliance with the so-called "Criteria for Riskiness of Operations." These criteria, though aimed at combating tax minimization schemes, often become a tool for groundless blocking of tax invoices of conscientious taxpayers.

In response to the suspension of registration, the Plaintiff provided all necessary explanations and copies of documents which, in its opinion, fully refuted the riskiness. However, following the review, the Main Directorate of the STS in Odesa Region still issued a Decision to refuse registration, citing alleged "provision by the taxpayer of copies of documents compiled/executed in violation of legislation." This ground is quite common but often formal and unsubstantiated, as the tax authority does not specify which "violations" were committed, making effective taxpayer response impossible.

A key point for the Plaintiff is that it considers its rights violated, as the STS decision is unsubstantiated and does not correspond to the actual circumstances of the economic operation. The case is subject to consideration in administrative proceedings under simplified claim procedure rules without summoning parties (in written proceedings), which, on one hand, accelerates the review, and on the other hand, requires the lawyer to provide maximum detail and justification of the position in the statement of claim and attached documents from the initial stage.

Desired Outcome:

Recognition as unlawful and cancellation of the STS decision to refuse tax invoice registration, obligation of the STS to register the invoice on its submission date to restore tax credit and ensure normal economic activity.

Responsible Lawyer:

Anna Andriivna Cherniavska — lawyer specializing in tax disputes, appealing STS decisions, and protecting taxpayers' rights in administrative courts.

Solution:

The legal strategy of lawyer Anna Andriivna Cherniavska was aimed at effectively protecting the enterprise's rights from unjustified actions of the tax authority. It involved a comprehensive approach to the preparation and support of the administrative lawsuit, complying with all requirements of the Code of Administrative Procedure of Ukraine (CAP of Ukraine).

- Meticulous preparation of the lawsuit.

The lawyer drafted the statement of claim with a deep justification of the unlawfulness of the STS decision. The explanations and documents provided by the plaintiff, which were ignored by the tax authority, were thoroughly analyzed, and the absence of violations in the compilation of primary documents was proven. The lawsuit included references to relevant norms of the Tax Code of Ukraine and judicial practice in similar disputes, ensuring a strong legal position. - Prompt correction of lawsuit deficiencies.

After filing the lawsuit, the court issued a ruling leaving it without motion, requiring the correction of certain deficiencies (proof of court fee payment, full information about the defendant, copy of the agreement). Lawyer Cherniavska A.A. demonstrated high efficiency, quickly finalizing and submitting all necessary documents and information (including the payment instruction for court fee and the full version of agreement №2802 from 28.02.2023), which allowed the court to accept the case for consideration. This is an important stage, as delays at this stage can lead to the return of the lawsuit, and consequently, to loss of time and opportunity for defense. - Ensuring case consideration under simplified procedure.

The lawyer ensured that all case materials complied with the criteria for simplified claim procedure. This allowed avoiding lengthy court hearings with the summoning of parties, contributing to a faster and more efficient resolution of the dispute in written proceedings, which is especially valuable for businesses requiring prompt resolution of tax issues.

Result: On November 20, 2024, the Odesa District Administrative Court ruled to accept the statement of claim from Limited Liability Company "ODESA FRUITS VEGETABLES" for consideration and open administrative proceedings. The case will be reviewed under simplified claim procedure rules without notifying the parties. The court set deadlines for filing a response, reply to the response, and objections.

This is an extremely important procedural step and an interim victory for the client. Thanks to the professional and prompt work of lawyer Anna Andriivna Cherniavska, the client gained the opportunity to proceed to the substantive consideration of the case and challenge the tax authority's decision, which, in its opinion, was unlawful and hindered its economic activity. The case demonstrates the effectiveness of judicial protection of taxpayers' rights and confirms that even in disputes with powerful state bodies like the STS, it is possible to achieve justice and defend one's rights with qualified legal assistance. This highlights the importance of thorough preparation of the statement of claim and prompt reaction to court requirements for successful business protection.