Forbes-recognized counsel and architect of the COMPASS framework, a strategic breakthrough for navigating international investments and business expansion, with over 5 years of experience in corporate law, including investment management, VC/PE, and cross-border transactions, contributing $15B+ in transactions across diverse sectors.•

Legal Support for Establishing a Polish Company Branch in the U.S.: Practical Experience in Florida

Expanding into the U.S. market is a crucial stage in the growth of any business, especially for European companies seeking global presence. However, opening a branch overseas involves not only new opportunities but also serious legal and administrative challenges. It is essential to comply with U.S. laws on business registration, taxation, and labor regulations.

A Polish entrepreneur, who already operated a stable manufacturing business in Europe, turned to attorney Miraziz Khidoyatov for legal assistance in entering the American market through the opening of a full-fledged branch. The client needed a comprehensive service covering legal structuring, tax optimization, and compliance with bilateral regulations.

Case Overview

The plan was to open a subsidiary in the state of Florida with independent business activity, the ability to enter into contracts, and manage payments through an American bank account. The objective was to create a reliable legal model that would account for the interaction between U.S. and Polish jurisdictions.

Key Implementation Stages

1. Developing the Corporate Model

A legal analysis of the Polish company was conducted, reviewing its ownership, management structure, and reporting format. Based on the client's goals, the chosen model was a U.S.-based subsidiary LLC fully controlled by the Polish parent company, allowing flexibility in administration and taxation.

2. Legal Registration of the Branch

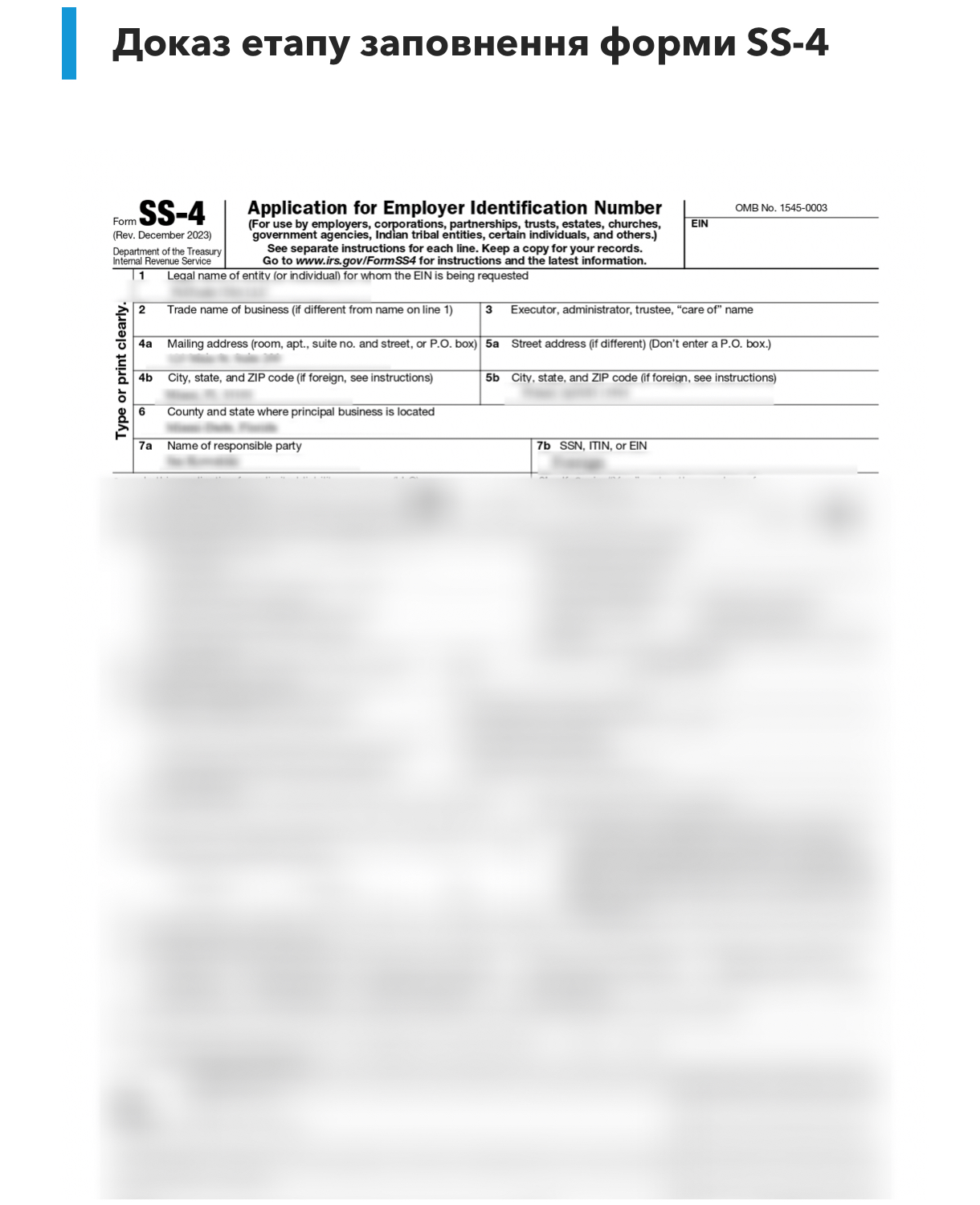

The LLC was registered in Florida, foundational documents were prepared (including the Operating Agreement), and an EIN was requested via form SS-4. A bank account was opened simultaneously, and a contract was signed with a local accountant for ongoing tax compliance.

3. Coordination with the Parent Company

To avoid double taxation and comply with transfer pricing principles, an intercompany agreement was signed between the Polish company and its U.S. branch. Form W-8BEN-E was also submitted, and a transparent reporting structure for both jurisdictions was established.

Document Package Included:

- Operating Agreement (LLC internal charter)

- SS-4 (EIN application)

- W-8BEN-E (non-resident status declaration)

- Intercompany supply agreement

Results

- The branch was registered in the U.S. without bureaucratic delays.

- EIN obtained, bank account opened for operations.

- Effective coordination established between the headquarters and the U.S. entity.

- The branch's non-resident tax status was officially confirmed.

Frequently Asked Questions

Is a visa required to open a company?

Physical presence and a visa are not required to register a branch. However, if you plan to manage the company in person, an appropriate visa such as L-1 or E-2 is necessary.

Which legal form is better?

An LLC is typically the best option for foreign owners due to its simplicity and tax advantages. The final choice depends on the business structure.

Is it mandatory to pay taxes in the U.S.?

If the branch conducts operations in the U.S., it is subject to local taxation. The U.S.-Poland tax treaty helps avoid double taxation.

This case highlights the importance of professional legal support when entering the U.S. market. Thanks to the expertise of Miraziz Khidoyatov, the Polish business gained a fully compliant and effective structure that meets all U.S. legal requirements and allows smooth operation in a new market.