My name is Sofia Kalytovska. I am a professional legal consultant from Ukraine. My key areas of law are contract and corporate law.

Initial Data:

A client — an individual and tax resident of Ukraine — contacted me. He runs a business through a company registered in the State of Delaware (USA). The company was used to provide IT and digital marketing services to international clients.

In 2023, the client became the sole beneficiary of the foreign company, and thus, under Ukrainian legislation, acquired the status of a Controlling Person of a CFC (Controlled Foreign Company).

After familiarizing himself with tax law updates, the client realized he was required to submit a notification on the CFC (Controlled Foreign Company) to the State Tax Service of Ukraine. Due to the complexity of terminology, ambiguous explanations on the official website, and lack of prior experience with such reporting, he sought legal assistance.

The Problem:

Since 2022, Ukraine has implemented CFC rules in accordance with Law No. 466 and subsequent amendments to the Tax Code. If an individual acquires a share in a foreign company (over 50%, or jointly with other Ukrainian residents more than 25%), they are required to notify the tax authority within 60 days from the moment they acquire such status.

Failure to submit the notification in time is subject to a fine of up to UAH 3,020 for each violation, and complete omission of the notification leads to even greater financial liability.

The client was unsure about:

what date should be considered the moment of acquiring control;

which fields must be filled in the notification;

how to correctly classify the ownership share;

which documents to prepare in case of a tax audit;

how to file the notification through the Taxpayer’s Electronic Cabinet.

Solution:

Full legal support for the CFC notification process was offered: from consultation to preparing and submitting the notification using an electronic signature.

1️⃣ Initial Consultation

I explained the key concepts:

who qualifies as a CFC controlling person;

what constitutes acquisition of a share;

types of notifications required by law (creation, acquisition, share changes);

deadlines for submission and penalties for violations;

when and how the obligation to declare CFC income arises (in the future).

We also agreed on the control acquisition date (based on U.S. corporate documents), and clarified the company name, registration form, jurisdiction, and business activity type.

2️⃣ Data Collection and Preparation

The client provided:

a Certificate of Incorporation from the Delaware state register;

a statement confirming the beneficial ownership structure;

information about ownership share, control acquisition date, and the company’s legal address;

a copy of the registration service agreement and founding documents.

Based on these documents, I prepared a draft notification in the format approved by the Ministry of Finance of Ukraine.

3️⃣ Submission of the CFC Notification

After approving the content, I:

generated the electronic notification in XML format;

submitted the document on behalf of the client via the Taxpayer’s Electronic Cabinet, using the client’s Qualified Electronic Signature (QES);

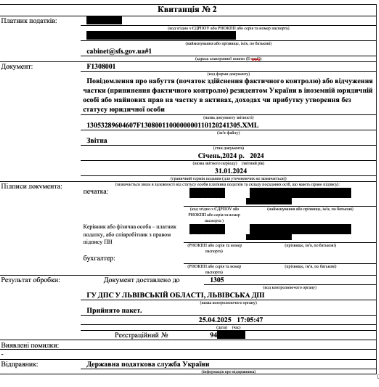

received Confirmation Receipts No.1 and No.2 confirming the submission;

provided the client with archiving instructions and guidance on future obligations.

The Client Received:

- A properly prepared and timely submitted notification on acquiring a share in a CFC;

Electronic receipts confirming the tax authority’s acceptance of the notification;

Written consultation on next steps (including the obligation to submit the annual CFC report, conditions for exemption from declaring CFC income, and grounds for taxation);

Recommendations on storing documents that confirm ownership structure.

Result:

The CFC notification was submitted on time, with no delays or technical errors. The client avoided penalties, prepared for future CFC income declarations, and received a practical template for future use in case of ownership structure changes.

CFC legislation in Ukraine is a new but mandatory area for many entrepreneurs operating through foreign entities. In this case, thanks to precise analysis and legal support, the client successfully fulfilled their obligation to the tax authorities and laid the groundwork for transparent interaction with regulators in the future.

Legal assistance in such cases helps avoid penalties, save time, and focus on growing international business without unnecessary risks.